colorado estate tax form

Beginning in August employees will need to use the new Colorado Form DR 0004 Colorado Employee Withholding Certificate to adjust Colorado state withholding tax. Colorado Estate Tax.

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Printable colorado state tax forms for the 2020 tax year will be based on income earned between january 1 2020 through.

. Ad Download Or Email Form 104 More Fillable Forms Try for Free Now. DR 0253 - Income Tax Closing Agreement. DR 1830 - Material Advisor Disclosure Statement for Colorado Listed Transaction.

DR 0158-I - Extension of Time for Filing Colorado Individual Income Tax. The Department of Local Affairs DOLA 1313 Sherman Street. DR 5714 - Request for Copy of.

Application for Property Tax Exemption. Ad We Can Help Your Estate Planning With Guidance and Resources From Our Specialists. Residential Properties Specific Forms For Charitable-Residential Properties.

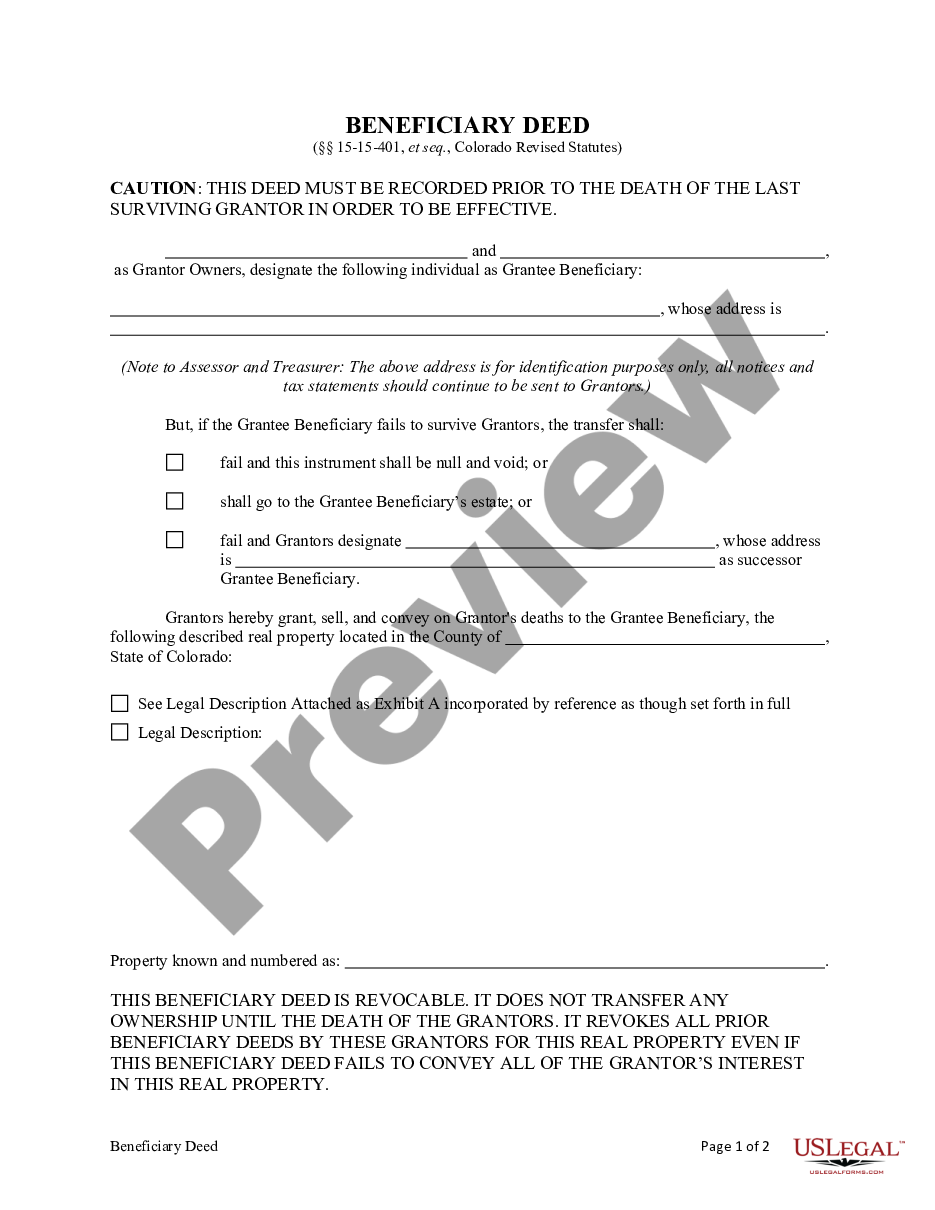

See Form 1041 instructions for information on when to file quarterly. DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing. Ad Make Your Free Legal Forms.

DR 1101- Annual Reconciliation of Income Tax Withheld on Gaming Winnings. This will be the only acceptable form to submit changes to your Colorado tax withholding. It is one of 38 states with no estate tax.

Application for an Affidavit Emissions Extension. The estate tax is levied on an estate after a person has died but before the money is passed on to their heirs. If the estate generates more than 600 in annual gross income you are required to file Form 1041 US.

Affidavit of Non-Commercial Vehicle. All forms must be completed in English pursuant to Colorado law see 13-1-120 CRS. If colorado tax is not withheld on the transaction check appropriate box on line 12.

There is no estate tax in Colorado. Every nonresident estate or trust with Colorado-source income must file a Colorado Fiduciary Income Tax Return if it is required to file a federal income tax return or if a resident estate or trust has a Colorado tax liability. Payment for Automatic Colorado Extension for Estates or Trusts Extension.

If the date of death occurs prior to December 31 2004 Form DR 1210 must be filed. DR 1102 - Address or Name Change Form. Identification of Applicant and Property Applicants First Name Middle Initial and Last Name Social Security No.

Get Started On Any Device. Under current law no Colorado estate tax filing is required for estates of individuals who die after December 31 2004. It is sometimes referred to as the death.

Estate Trust Estimated Tax Voucher Extension. An estate may also need to pay quarterly estimated taxes. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit.

Application for Change of Vehicle Information IRP DR 2413. DR 0104X - Amended Individual Income Tax Return. DR 1083- Information with Respect to a Conveyance of a Colorado Real.

The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be obtained by filing the proper extension request form. Create Legal Documents Using Our Clear Step-By-Step Process. Estate Tax Return Tax Return.

Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. A state inheritance tax was enacted in Colorado in 1927.

DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest. Ad Register and Subscribe Now to Work on Form 104 More Fillable Forms. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

223 rows Sales Tax Return for Unpaid Tax from the Sale of a Business. Ad Get Access to the Largest Online Library of Legal Forms for Any State. DR 1778 - E-Filer Attachment Form.

Additional information on filing can be found on the Colorado Department of Revenue. DR 0105 is a Colorado Estate Tax form. DR 1079 - Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers.

Real Estate Withholding Forms. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. Closing Agreement - Estates Trusts.

What Is the Estate Tax. Form DR 1210 is a Colorado Estate Tax form. Ad We Can Help Your Estate Planning With Guidance and Resources From Our Specialists.

Instructions for Closing an Estate Formally Download PDF Revised 0919 JDF 958 - Instructions for Closing a Small. PROPERTY TAX EXEMPTION FOR SENIORS CONFIDENTIAL County Name Address Address SE001-030508 Phone Number and Fax Number 1. DR 0204 - Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax.

DR 0105 Book - Colorado Fiduciary Income Tax Filing Booklet. Income Tax Return for Estates and Trusts. For the colorado department of revenue its form 1041.

The Colorado income tax of a nonresident estate or trust shall be. DR 0900 - Individual Income Tax. DR 0900F - Fiduciary Income Payment Form.

Affidavit of Non-residence and Military Exemption from Specific Ownership Tax. Authentication of Paid Ad Valorem Taxes State Assessed Forms.

State Individual Income Tax Rates And Brackets Tax Foundation

Colorado Transfer On Death Deed Or Tod Beneficiary Deed Colorado Deed Beneficiary Form Us Legal Forms

Business Sales Use Tax License Littleton Co

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Free Colorado Small Estate Affidavit Form Pdf Formspal

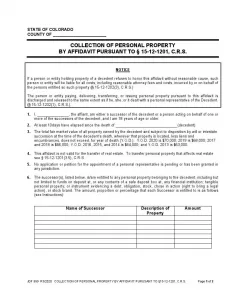

Solved Estate Tax Return Problem Clark Griswold Ssn Chegg Com

State Corporate Income Tax Rates And Brackets Tax Foundation

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Where S My State Tax Refund Updated For 2022 Smartasset

Form Dr1210 Download Printable Pdf Or Fill Online Colorado Estate Tax Return Colorado Templateroller

Property Tax Calculator Estimator For Real Estate And Homes

Understanding The Estate Tax Return Marotta On Money

Fill Free Fillable Colorado Department Of Regulatory Agencies Pdf Forms

2022 State Tax Reform State Tax Relief Rebate Checks

Personal Property Agreement Ppa22 Pdf Fpdf Docx Colorado

Colorado Estate Tax Everything You Need To Know Smartasset